31+ Monthly debt payment calculator

Plug in your debt details. Your desired payoff time-frame is the amount of time you would like to pay off your debt.

The Measure Of A Plan

Its easy to add more than one account to the debt calculator.

. Divide this total by 7000 gross monthly income. This will help calculate how much you will need to pay each month including interest. You can choose the payoff time in months or years.

With our calculator you wont have to dig through a sea of bills to calculate your payment plan. B2 A1 A2. Apart from this tool you may also be interested in our debt reduction calculator that can help you perform more advanced calculations such as.

D1 C1 CDB. But if you pay 350 per month you can remove 9 months off your payment time. Make a debt payment plan that works for you.

I asked a financial planner to help me. As a quick example if someones monthly income is 1000 and they spend 480 on debt each month their DTI ratio is 48. D2 C2 CDB.

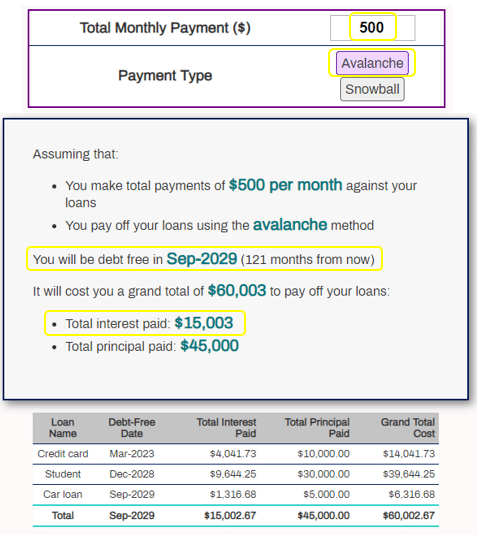

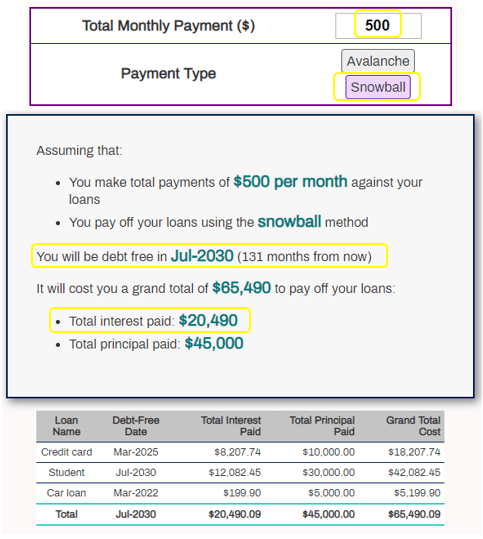

Determine which debt to start repaying first. The calculator below estimates the amount of time required to pay back one or more debts. This represents the.

Our debt avalanche calculator will show you which debt to start repaying first based on your balance with the highest. You also save 347 in interest if you pay 350 every month. In fact you only need 3 pieces of information about your debt accounts to use the debt calculator.

The calculator uses this to calculate how long it will take to pay off your debts and how much you will pay in interest. Finding when you will be debt free in case you decide to make extra payment regularly in smaller amounts and what are the savings in. With Bidens 10000 student-loan forgiveness my monthly payment can be as low as 150 a month.

For example if you have an auto loan with a monthly payment of 500 your first months payment might break down into 350 toward interest and 150 toward the principal. Additionally it gives users the most cost-efficient payoff sequence with the option of adding extra payments. For example if you owe 5000 on a high-interest credit card and your minimum monthly payment on that card is 100 then 100 is the minimum monthly debt.

This calculator utilizes the debt avalanche method considered the most cost-efficient payoff strategy from a financial perspective. Ad Our easy-to-use calculator can help see if you might qualify for debt relief. Youll also be able to see how much principal versus interest youll pay over the lifetime of the debt.

Simply enter the total balance of your current of future debts expected interest percentage rate details then desired monthly. This calculator will provide you with the approximate amount of time it will take to pay off a particular debt. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

C1 A1 CMP. Include all your debtsminus mortgage s if you have anywith the account types balances interest rates and minimum amount due each month. Consolidating many high-interest debts into a single lower monthly payment can.

The lowest monthly payable. Add the total house payment of 120891 to the debts of 490 from Step 3. Priority Payments Certain debts must be paid off with priority.

Explore the possibilities of student loan forgiveness program with an Equitable 403b. If you keep paying 250 each month it will take you 2 years and 5 months to completely pay your balance. Then click on the pull-down menu and indicate whether youre making declining minimum or fixed payments.

Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much youll need to pay each month based on how much you owe and your interest rate. First enter your monthly payment the percentage of interest youre paying and the remaining principal balance of your debt. You can then quickly draw up a repayment plan stating which arrangement you can propose to which creditor.

If they had no debt their ratio is 0. The debt payment calculator helps you to calculate how long it will take to pay off debt and how you can relieve your debt with our online calculator. About this Debt Re-payment Calculator.

The total is 169891. This is the formula the calculator uses to determine monthly compounding interest. The result is 24 percent.

E2 D1 D2. C2 A2 CMP PDA. Create a Debt Payment Plan.

Monthly 2nd mortgage payment. This is one of the best debt repayment calculators we provide for you to use to help you calculate your monthly credit card loan or line of credit payments online for free. The last time I made monthly payments in 2018 I paid 370.

How To Start A Budget Journey To Financial Freedom Budgeting Budgeting Tips Budgeting System

31 Free Personal Finance Homeschool Resources

31 Free Personal Finance Homeschool Resources

![]()

The Measure Of A Plan

20 Life Changing Financial Freedom Books The Minted Latte

Free 9 Sample Loan Amortization Chart Templates In Ms Word Pdf Excel

How To Pay Off Debt Fast Myhomeanswers

31 Useful Interesting Excel Projects Ideas To Do At Home

How To Pay Off Debt Fast Myhomeanswers

Free 9 Sample Loan Amortization Chart Templates In Ms Word Pdf Excel

Emergency Fund Is 1k Actually Enough Our Bill Pickle Emergency Fund Emergency Fund Saving Retirement Quotes Funny

Pin On Family Fun Food Frugality Group Board

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

Pin On Bible Study

The Measure Of A Plan

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

Free 9 Sample Loan Amortization Chart Templates In Ms Word Pdf Excel